How to withdraw money from Wise to bank account

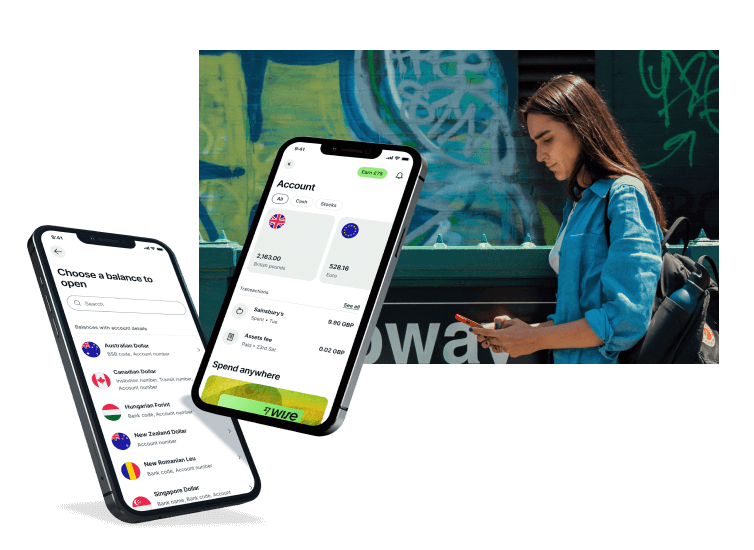

Wise accounts can be used to receive payments fee free in 10 currencies, and to hold any of over 50 supported currencies. If you’ve got a balance in your Wise account you might want to withdraw it to your regular bank account, or use your Wise card to make cash withdrawals from an ATM overseas.

In this guide we’ll cover how to withdraw money from Wise to a bank, how to use your Wise card to make ATM withdrawals, and all you need to know about the fees and limits involved.

How to withdraw money from a Wise account

If someone has sent you a payment to your multi-currency Wise account, or if you’ve got a balance in your Wise account that you want to use, you can withdraw your money from Wise in SGD or the currency of your choice.

You can withdraw money from Wise in two main ways:

Send the money from a Wise balance to a bank account

Get a Wise card and withdraw cash

If someone is sending you a payment through Wise, it’s also good to know you can have the funds deposited to your regular bank account if you’d prefer. There’s no need to have a Wise multi-currency account to receive money through Wise at all if you don’t want to - we’ll also touch on how receiving money with Wise without a Wise account works, a little later.

Option 1: Withdraw money from Wise to a bank account

If you hold a Wise balance in any of the 50+ supported currencies, you can withdraw some or all of your money to a bank account. You’ll be able to either send funds without switching currencies, or convert a balance in your Wise account to the currency you need as part of the withdrawal.

Here’s how to withdraw money from Wise to a bank account easily in the Wise app:

Log into the Wise app and select the balance you want to withdraw from

Simply tap the currency balance you want to withdraw from in the app’s home page, to see your balance in that currency, and your options.

- Select Send and enter or choose the bank account you want to withdraw to

You’ll be able to select a recipient account from those you’ve previously withdrawn or sent money to, or tap add a new recipient to enter a new bank account. You can save accounts under a nickname to make it easier to find them next time, too.

- Enter the amount you want to withdraw

Enter the value you want to withdraw, confirm the currency, and check any fees that apply to your withdrawal. You’ll also get a delivery estimate so you’ll know when to expect the money to arrive.

- Confirm the payment to transfer your balance to your bank account

Check everything over, confirm the payment using your 2 step authentication settings, and you’re good to go. You’ll be notified in the app when your transfer is being processed.

Withdraw money from Wise to a bank account - fees

If you’re withdrawing from Wise without any currency conversion - so from an SGD balance to a Singapore based SGD account, for example - there’s just a small transfer fee to pay. Here are the Wise fees to withdraw SGD to a bank account in SGD , using a bank transfer, across a couple of payment values:

| Withdrawing SGD to an SGD account - withdrawal amount | Withdrawing SGD to an SGD account - Wise fee |

|---|---|

| 500 SGD | 0.54 SGD |

| 5,000 SGD | 0.54 SGD |

If the currencies are different - withdrawing from a Wise SGD balance to a EUR account, for example - you’ll see the exchange rate being used, the currency conversion fee and how much you’ll receive in your bank account once the withdrawal has been processed. Currency conversion uses the mid-market exchange rate and low fees from 0.41%. To illustrate, here are the Wise fees to withdraw SGD to a EUR bank account, using a bank transfer, across a couple of payment values:

| Withdrawing SGD to a EUR account - withdrawal amount | Withdrawing SGD to a EUR account - Wise fee |

|---|---|

| 500 SGD | 2.55 SGD |

| 5,000 SGD | 22.26 SGD |

Click here to read more about Wise fees.

Withdrawal limit

Wise has a withdrawal limit which varies based on how you want to send your SGD payment. The maximum payment amount can be as high as 1 million SGD , and you’ll always be shown the limits which apply when you’re setting up your withdrawal.

Option 2: Wise cash withdrawal at an ATM

Wise account holders can also get a Wise international debit card and use it to make cash withdrawals at any of millions of ATMs overseas. All account holders can make some free withdrawals every month, in 170+ countries, with low fees once your free transactions are exhausted. It’s helpful to know upfront that Singapore Wise card holders can not make ATM withdrawals here in Singapore - but the card can be used in most other countries, making this a good option when you’re travelling.

There’s a one time order fee of 9 SGD to pay when you get your first Wise card, with no monthly or annual fees after that. You’ll also get a digital card you can use instantly, and some free ATM withdrawals every month. More on the Wise ATM withdrawal fees and limits, next.

Let’s walk through how to order a Wise debit card step by step, so you’ll be ready to withdraw cash from your Wise account.

Here’s how to order and activate a Wise card:

Log into the Wise app or head to the Wise desktop site

Tap the Cards tab and order your Wise card - you’ll need to have a currency balance to place your order

Confirm your personal details, and complete any required verification step

Pay the one time order fee of 9 SGD

Your Wise card will arrive in the post, and you’ll be able to use your Wise digital card instantly online, or to make mobile payments through a service like Apple Pay

Once your physical Wise card arrives you can activate the contactless feature by making a chip and PIN payment or checking your balance at an ATM

Once you have your physical Wise card you can make cash withdrawals at ATMs overseas. Simply insert your card and enter the Wise PIN which you can find in the Wise app easily - just like using any other ATM card.

Wise withdrawal fee

You can take out cash from an ATM for free twice a month, up to a total amount of 350 SGD . After that, there’s a fee of 1.50 SGD per transaction, plus 1.75% of the withdrawal amount.

If you’re withdrawing in a currency you don’t hold in your Wise account, your Wise card will convert funds from the currency balance that offers the lowest possible fees, with conversion costs from 0.41%.

Wise ATM withdrawal limit

Wise ATM limits for Wise cards linked to Singapore Wise accounts are as follows:

Single withdrawal limit: 1,750 SGD

Daily withdrawal limit: 2,700 SGD

Monthly withdrawal limit: 5,250 SGD

It’s helpful to know that the monthly limit of 5,250 SGD is the default limit, and can be adjusted to 7,000 SGD in the Wise app if you’d prefer. ATM operators might have their own limits which could be lower than the Wise limits imposed.

Receiving money from Wise

The options we’ve looked at so far cover how to withdraw money from a Wise account if you already hold a Wise balance. However, you don’t necessarily need a Wise account to receive money through Wise. If someone wants to send you a payment through Wise you can simply give them your regular bank details, and they can set up the transfer to be deposited right to your normal bank account. You won’t need to do anything to get your money, and the sender can set up a notification so you get an email when the payment has arrived in your bank account.

Conclusion: How to withdraw money from Wise

You can withdraw money from Wise if you hold a Wise balance in any of the 50+ supported currencies in the Wise multi-currency account. Withdraw from your Wise currency balance by sending the funds to your preferred bank account, or by getting a Wise debit card to make a cash withdrawal abroad.

If you’ve not got a Wise account, you can still get paid through Wise to your regular bank account. Just give the person sending you money your normal bank details, and the payment can be deposited right into your account for convenience - with many payments arriving instantly. Use this guide to help you withdraw a Wise currency balance easily, or to get paid by someone else right to your bank account with a Wise low cost transfer. Easy.

FAQs

Withdraw a Wise currency balance by sending it to your normal bank account, or by ordering a linked Wise debit card that allows you to make cash withdrawals overseas. There’s a low fee to make a withdrawal from Wise to your bank account, and all Wise card holders can make up to 2 ATM withdrawals fee free every month, to a maximum of 350 SGD. Low ATM fees apply after that.

Yes. If you hold a Wise account balance you can withdraw it back to your regular bank account, or get a Wise debit card to withdraw your money from an ATM abroad. There’s a low fee to withdraw funds from Wise to a bank, which varies depending on whether or not you need to convert currencies to complete your withdrawal. All Wise card holders can make some fee free ATM withdrawals every month, too.