How Long Does an International Money Transfer Take? 2026

How long it takes for your international money transfer to arrive can vary widely, depending on the value of the payment, the destination country and the currencies involved. The provider or bank you select can also make a big impact.

Overall, banks usually take longer to process international money transfers, while fintech providers, like Wise or Remitly can be faster - and may also be cheaper, too.

Quick summary

We’ll dive into the details in just a moment. First, here’s a summary of how long international payments may take when sent with a couple of our major banks, compared to some specialist services.

| Bank or provider | International money transfer time |

|---|---|

| Wise | Around 50% of payments are instant, 90% arrive in 24 hours |

| Remitly | Express payments can be instant, Economy payments may take a few days |

| OFX | Payments on common routes can arrive in 24 hours, or a couple of days at most |

| DBS | 2 - 4 days |

| UOB | 1 - 5 days |

How long does an international money transfer take?

When you send an international money transfer with a bank, it’s usually processed through the SWIFT payment network. In this system, your money is passed by your bank, to the recipient’s bank, via one or more intermediary banks. This process is safe and reliable, but it can also be slow and expensive - and mean that your payment takes up to 5 days to arrive.

Specialist providers often have their own payment networks to get around SWIFT, which can mean your money arrives far faster.

International money transfers with providers

If speed is of the essence, a specialist service might get your money moving faster than your bank can. Let’s take a look at a few popular options.

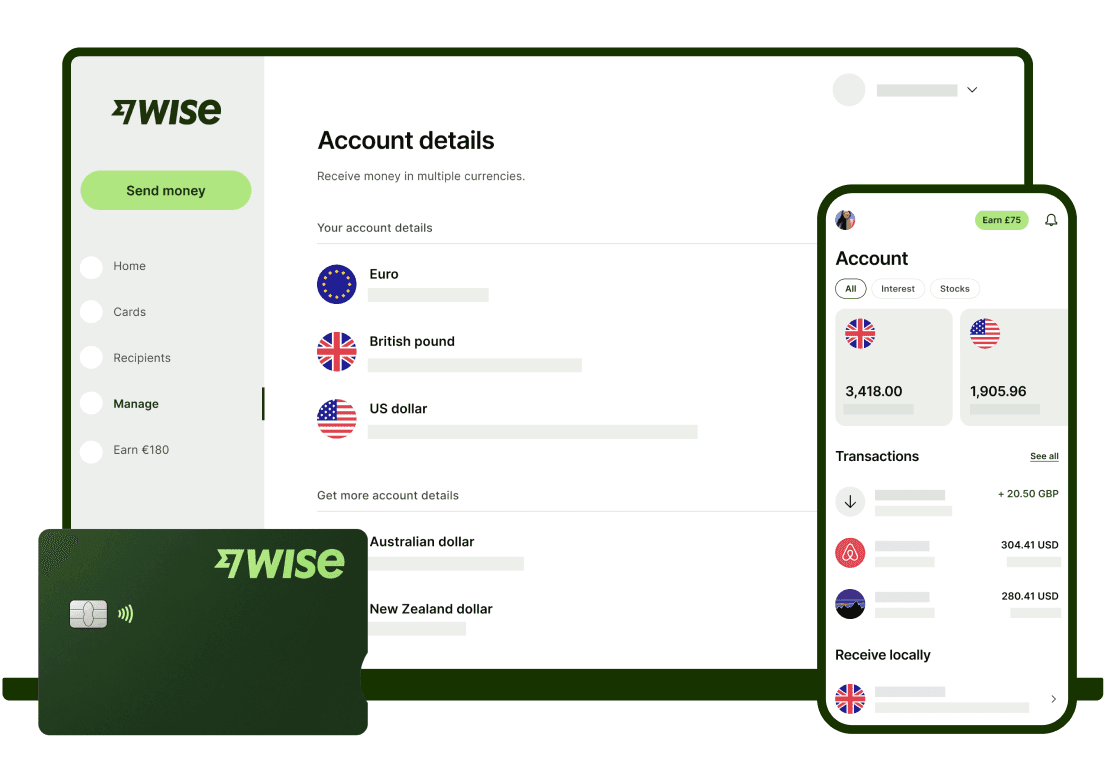

Wise

Wise international transfers are fast, and you’ll be able to see a delivery estimate before you confirm your transfer, so you’ve got an idea of when your money will land. Around 50% of Wise transfers are instant, 90% arrive in 24 hours, and the rest should arrive safely in up to 3 business days.

When you send money with Wise you’ll get the mid-market exchange rate to convert your dollars to the currency needed - and you can also choose to open a multi-currency Wise account, to hold 50+ currencies and get a linked debit card to spend in 170+ countries.

Pros:

Fast payments which can arrive instantly

Mid-market exchange rate and low fees

See a delivery estimate before you confirm

Cons:

Payments to bank accounts only - no cash collection options

Deliver times do vary based on destination

OFX

When you send a payment with OFX you’ll be able to track it in the OFX app or by logging into your account online. OFX also has a super handy 24/7 phone service so you can also talk through your transfer with a customer service agent if you need to. Payments made on common currency routes can arrive within 24 hours. Most other payments will land in a day or two - with some exotic currencies taking a little longer, up to about 5 days.

OFX also offers currency risk management services to individuals and businesses, as well as multi-currency accounts for online sellers and business owners.

Pros:

Common currencies can arrive in 24 hours

Broad range of currency services available

24/7 support if you need it

Cons:

Payment methods vary, so you might be limited to funding your transfer via a bank, rather than paying by card or cheque for example

Delivery times vary and can be longer for unusual currencies

Remitly

Remitly transfer services can vary a little depending on where you’re sending money to. However, you can often choose between a cheaper Economy payment, which you’ll fund through your bank account, or a faster Express payment which you can pay for with a debit or credit card. Economy payments take 3 to 5 business days to arrive, while card payments can take minutes - especially if you opt for transfers to be collected in cash at the other end.

Pros:

Pick the delivery time that suits your needs - with fees to match

Cash pay out options

Set up your transfer conveniently online or in-app

Cons:

Not all countries and currencies are supported

Cheaper payments take longer to process

International bank to bank transfers

Of course, you can also send a payment through your normal bank, instead of using a third party. If you’re sending a transfer to another account held within the same bank - even if it’s overseas - you might well find you get a better price and a faster transfer time.

However, for standard transfers which are processed through the SWIFT network, you’ll normally need to wait between 3-5 business days for your money to arrive.

International transfers aren’t a core activity for traditional banks, which can mean they’re more expensive compared to specialist services, including exchange rates which have a higher markup. It also means that few banks have invested in new ways to process international transfers - which can mean slower overall delivery times.

What can slow down an international bank transfer?

So, you’ve sent your international payment. What could cause a delay now? Here are a few things you should know about in advance, just in case any cause delays on your payment.

1. Additional checks - banks and transfer services have to comply with local and international financial service regulations, which can mean they’re obliged to carry out additional verification and checks - especially when you’re sending higher value payments. To avoid this causing an issue, ask the provider in advance what paperwork they may need, and provide it at the point of transfer.

2. Wrong recipient information - if you use incomplete or incorrect recipient information, including the name, bank name and address, bank account number and routing information, your transfer will be delayed. It could even be rejected and returned to you - or, even worse, deposited into the wrong account. To avoid this causing an issue, check and double check you have all the details correct before you hit confirm.

3. Currency conversion - when you send money overseas your funds need to be converted from dollars to the currency you need to deposit into the recipient’s account. Depending on the provider you pick, it may take a little while for your money to arrive and be cleared in dollars - and then a bit longer still for the funds to be exchanged and sent on. To avoid this causing an issue, ask the bank or provider to give you a delivery estimate before you send your payment. If it doesn’t suit your needs, check out some alternative services like Wise or OFX, which may be faster.

4. Bank holidays & weekends - banks only work during core banking hours, which means your transfer might be delayed if you’re arranging it out of hours, at a weekend or over the holidays. To avoid this causing an issue, use a specialist provider which can offer a 24/7 service and get your money moving right away.

What is needed to make an international transfer?

So, what information is needed for an international money transfer? Exactly what’s required might vary a bit based on the provider you’re using and the payment details. However, you’ll normally need the following information to set up your overseas payment:

The name or company name of the recipient

Recipient’s account number, and any relevant routing information

Recipient’s bank’s SWIFT code, name and address

The amount, currency and date of transfer

Some countries may ask for extra information, such as the reason for the transfer or the recipient’s home address. And if you’re sending a high value payment you might also need a bit of extra paperwork for verification purposes - the provider will confirm this with you when you set up the transfer.

Are there any fast international money transfer options?

Fintech providers, like Wise or Remitly can often offer a fast international transfer service, with delivery times which are quicker than regular banks. Western Union is another good option if your recipient doesn’t have easy access to a bank account or ATM, as they can help set up cash transfers that can be delivered on the same day, and collected via the global Western Union agent network.

How to transfer money internationally

Transferring money internationally doesn’t have to be complicated. There are lots of different options out there, from traditional banks and newer online and in-app specialist services. The exact process you’ll follow can vary slightly depending on the provider you use - but here’s an outline of the steps needed to transfer money internationally:

Choose the bank or provider you want to arrange your transfer with

Create or log into your account, or visit a branch if you’re transacting in person

Enter the payment details, including the amount and currency you’re sending

Add the recipient’s information - their name, address and bank details

Get a quote for the fees and exchange rates that apply - you may also be able to see a delivery estimate at this stage

Fund your transfer with your bank account or card

Your money will be sent, and you can track your payment in the bank or provider’s app or online service

How long does it take to receive an international transfer

Waiting for a payment yourself? How long it takes to arrive depends on the way the money is transferred to you, the currencies involved, and other factors like the time the transfer was made, and whether there are any holidays in either your own country, or the sender’s country.

Let’s look at a few examples of how long it takes to receive an international transfer with some popular specialist services.

Receiving money with Wise

If someone sends you a Wise payment it can be deposited right to your regular bank account with no need for you to do anything at all. If you have an active Wise multi-currency account you can also receive money there if you’d prefer.

Wise delivery times vary based on the country and currency involved - but 50% arrive instantly or within seconds, and 90% arrive on the same day they’re sent. The sender can track the payment as it’s being processed, and can also add your email address so you get an email when your money is available.

Receiving money with Remitly

Remitly payments can be sent to bank and mobile money accounts or for cash collection. The exact services available vary based on the country the sender and the recipient are in - and the delivery time will depend on exactly how the sender chooses to set up the transfer.

In many cases, the person sending you money can choose to pay with a bank card for an Express payment, which will be deposited or ready to collect in cash in minutes. Alternatively, they can pay with a bank transfer, and your money will be available in 3 to 5 days.

Receiving money with Revolut

Revolut can help customers set up transfers to other Revolut accounts and also to bank accounts around the world. Payments sent from one Revolut account to another arrive instantly, transfers made to cards take from a few minutes to about half an hour. If you’re receiving money to a bank account through Revolut, it’ll be deposited in 3 to 5 business days.

Conclusion

International money transfers which are set up through your regular bank can take 3 to 5 working days to arrive through the SWIFT payment network. Specialist online providers have often built their own payment networks which can make moving money across borders faster - and cheaper, too.

The exact amount of time it takes for your payment to arrive will depend a lot on where you’re sending money to, the value of the transfer and the currencies involved. However, fintech companies and specialist international money transfer companies, like Wise, OFX, and Remitly, can often be faster, with some payments arriving instantly or in just a few minutes.

FAQ - How long does an international money transfer take

IBAN payments are often used when sending from Singapore to Europe. If you send your payment with your regular bank you may find it takes 3 to 5 days to arrive. Specialist services like Wise or OFX might be able to help you arrange a faster transfer if you need it.

SWIFT is the payment network most commonly used by banks when setting up international payments. SWIFT payments can be made to more or less any country in the world - but they may take 3 to 5 days to land.

If you’ve sent your payment with an international money transfer specialist, you’ll usually be able to track the payment online or in the provider’s app. If you sent your money with your bank, you might need to ask them to track the payment if you’re concerned about it. All banks can do this - but they might charge a fee for the service.